Travel Insurance Medication Coverage: What’s Included and What’s Not

When you’re planning a trip, travel insurance medication coverage, the protection that helps pay for prescription drugs while you’re away. Also known as travel health insurance for prescriptions, it’s not automatic—many policies treat meds as an afterthought, not a core benefit. You might assume your plan covers your daily pills, but if you’re taking something like lisinopril, topiramate, or even a common antibiotic like trimethoprim, you could be left paying out of pocket if something goes wrong overseas.

Most standard travel insurance policies only cover emergency medical treatment, sudden, unexpected health crises like infections, injuries, or heart attacks. That means if your anxiety meds run out, your blood pressure pills get lost, or you need a refill of your hCG injection while abroad, you’re on your own—unless your plan specifically includes prescription drug coverage, a rider or add-on that pays for replacement medications during travel. Even then, there are limits: some insurers won’t cover controlled substances, high-cost specialty drugs, or meds you didn’t have before you left. And forget about coverage for new prescriptions you didn’t plan for—like if you develop traveler’s diarrhea and need azilsartan or another drug not on your original list.

What most people don’t realize is that travel insurance medication coverage, isn’t just about getting your pills—it’s about avoiding costly, dangerous gaps in care. If you’re managing chronic conditions like hypertension, epilepsy, or depression, missing doses can lead to hospitalization. That’s why policies that include medication replacement, the ability to get emergency refills or replacements for lost or stolen prescriptions are worth the extra cost. Some plans even cover consultations with local doctors to get new scripts, which can be a lifesaver in countries where your meds aren’t available under the same name.

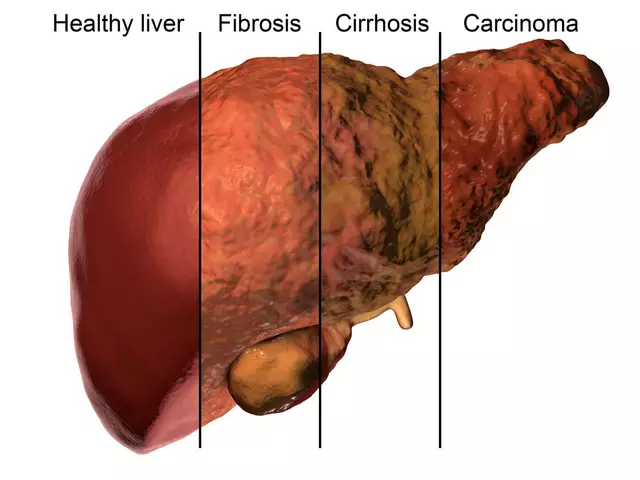

You’ll also want to check if your policy covers medication-related complications, like kidney damage from NSAIDs or hyperkalemia from trimethoprim. If you end up in a foreign ER because your meds caused a reaction, you need to know whether the treatment is covered—or if you’re stuck with a $10,000 bill. The same goes for drug interactions. If you’re on multiple meds, like those used for Tourette’s or alcohol dependence, and something goes wrong, your insurance should cover the follow-up care.

The good news? You don’t have to guess. Many top travel insurance providers now offer clear breakdowns of what’s covered. Look for plans that list medication coverage as a standalone benefit, not buried in fine print. Ask if they work with international pharmacies, if they require pre-approval for refills, and whether they cover both generic and brand-name versions. And always carry a doctor’s note—some countries won’t let you bring in meds without proof they’re prescribed.

Below, you’ll find real-world guides on how common medications interact with travel risks, what to do when your prescriptions run out, and how to avoid dangerous gaps in care abroad. Whether you’re taking antivirals, antidepressants, or fertility drugs, these posts give you the facts you need to stay safe and covered—no matter where your journey takes you.

Travel insurance can cover emergency medications abroad - but not your regular prescriptions. Learn what’s included, how to file claims, and which providers actually pay out when you need it most.

Chris Gore Nov 14, 2025