Pharmacy Discount Card Hacks: How to Stack Savings Without Breaking the Rules

How Pharmacy Discount Cards Work: The Real Story

If you take regular meds, you’ve definitely seen offers for pharmacy discount cards. Seemingly endless options: tiny cards from insurance companies, flyers in your mailbox, printable coupons online, and apps that flash deals before you blink. But it’s not just about grabbing a random card and waving it at the pharmacist. The way these cards function is actually pretty interesting—and yes, knowing how they operate lets you squeeze every ounce of savings out of them.

The big thing to know: These cards aren’t insurance. They negotiate prices with the pharmacies, sort of like loyalty cards at the supermarket. Each card is tied to agreements with a Pharmacy Benefit Manager (PBM). Think of PBMs as the middlemen connecting drug companies and your local pharmacy. The PBM offers a lower rate, the card passes that discount onto you, and the pharmacy accepts less profit in exchange for your business—because they want foot traffic and more customers.

Here’s the kicker: Pharmacies get paid the discounted rate immediately, but the cost difference gets made up by the card provider or the PBM behind the scenes. So it’s not a scam—just good old-fashioned wheeling and dealing, with companies betting you’ll buy a few off-script items along the way (hello, chocolate bars and band-aids at the checkout).

It’s not rare to see price swings of $5...or even $50...on the same medication, just depending on which card or app you pick. Many households don’t realize that the price is so variable that it _does_ pay to shop around for each refill. GoodRX, SingleCare, Optum Perks—each pulls from their own deal pool, so the price you see on one app might get beaten by another just a minute later.

You might be surprised to learn that pharmacists themselves often aren’t in control of these prices and might not even know why one app gives you a killer discount and the next doesn’t. The digital age has turned the prescription counter into its own kind of stock market.

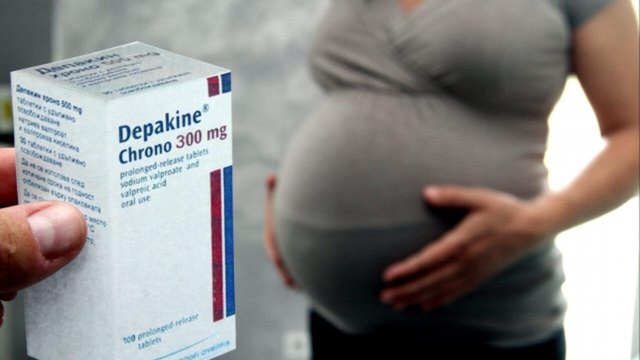

The magic word here is "eligible." Some meds, like controlled substances (e.g., Adderall, Oxycodone), often aren’t covered by the big discount programs. Insurance, government programs (like the PBS in Australia), and manufacturer coupons may also play by their own rules. The cards usually only work for generic, off-patent, or widely prescribed medications, though there are exceptions.

So, key takeaway: pharmacy discount cards work because of negotiated backend deals—not charity, not insurance. The right combination can cut your costs in a big way, if you know how to work the system. And that’s exactly what you’ll get to do with the stacking tips coming up.

The Stacking Game: What’s Allowed vs. What’s Banned?

This is where it gets spicy. Everyone wants to stack discount cards like coupons at the supermarket—but pharmacies aren’t that simple. If you just try handing over three cards for the same prescription, you’ll get a confused smile or, worse, a flat-out denial of all the discounts. Here’s how stacking pharmacy discounts really works and how to keep things kosher.

You can only use one pharmacy discount card or coupon per prescription per transaction. No exceptions—that’s a rule set not by local staff but by the systems that process the payment. If you try running two at once, the computer at the pharmacy will simply block the second one. This isn’t something you can talk your way out of.

BUT—and this is a huge but—you can compare prices from multiple cards and choose the best one each time you fill a script. You’re never locked into sticking with one discount forever. And since the prices can change weekly (or daily!), it’s almost always worth running each of your top apps or cards before you hit the counter.

Where does real stacking come in? A few legal workarounds exist:

- Switching between fills: Use one discount card this month, a different one next. No pharmacy penalizes you for using a new card each time.

- Family/friends: If a family member gets their own script, they can (with permission) use a different discount card than you. Each transaction is separate, so each can apply one coupon.

- Combination tricks: Some pharmacy chains actually offer in-house coupons or loyalty discounts that may stack on top of an outside discount card—ask about these. These aren’t always advertised, but sometimes you’ll get a flyer or see a digital promo.

- Pharmacy and app combos: Check if your pharmacy has a rewards program on top of outside discounts—rare, but it happens (and it’s sweet when it does).

On the forbidden list? Don’t try combining insurance with a discount card for the same fill. It won’t work. Also, most manufacturer coupons don’t stack with discount cards or each other—they each process as a form of insurance or primary payer. Medicare and government programs nearly always block discount cards as well.

Sneaky idea: Some folks split prescriptions (say, filling half now, half later) to use multiple cards on the same med. You need to discuss this with your pharmacist, and it’s very dependent on state/province/national laws. Not every pharmacy will allow back-to-back fills, but sometimes it works if you have legit reason (like travel or changing insurance).

Read the back of your discount card or app rules; every program spells out what’s in and out of bounds. If in doubt, ask your pharmacist or call ahead. A real conversation often unlocks more than you’d think—sometimes a cashier knows of a special deal or a partner program.

Step-by-Step: Stacking Discount Cards Without Getting Denied

Let’s walk through a real strategy you can use, without stepping on the pharmacy’s toes or getting your discount blocked. Here’s the approach I use myself in Melbourne, because raising Ted (and feeding him plus his endless sniffles) means every dollar counts.

- Make your list of meds: Write down every ongoing prescription. Don’t forget about one-off antibiotics or emergency refills, because price swings can be wild even for those.

- Check every discount card or app: I usually use GoodRX, SingleCare, and my pharmacy’s in-house program. Don’t limit yourself—search on two or three. If you’re in Australia, check if your chemist has a recurring deal, plus local drug-savings apps that work (I’ve found plenty at [this list of drug-savings apps](https://ag-guys.su/blog/top-5-goodrx-alternatives-for-prescription-savings-in)).

- Screenshot or print your best offer: Some pharmacies want the paper version, some just need a digital barcode or numbers. Having the proof handy saves time, especially if there’s a dispute at the counter.

- Call ahead or stop by off-peak hours: If you’re trying something out of the ordinary—like using a less-known app or a new pharmacy—call ahead, ask for the pharmacist, and double-check that they accept outside discount programs. Some chains (like Chemist Warehouse in Australia, or some CVS/Walgreens in the US) pick and choose which cards they take, so get it in writing if you can.

- Present your chosen offer at drop-off: Do it before you hand over your prescription, not after. If you wait until they’ve rung it up, it’s a headache for them to reverse everything.

- Check the receipt for savings: Make sure the discount applied. If the total seems off, ask the pharmacist to rerun the script with a different coupon. I’ve caught errors this way, and staff are often happy to help you try another app or card if you’re polite.

- Switch it up next fill: When the time comes to refill, don’t just auto-renew. Re-check your top apps, because prices change and you might see a better deal with a different card or pharmacy.

Bonus trick: If your family is big or you’re filling for multiple folks at once, sometimes splitting scripts between different pharmacies gives you even more leverage. I’ve filled my son’s meds at one chain and mine at another to maximize discounts for each with a separate card or promo.

Be nice to your pharmacist—if you’re courteous, they’re much more likely to flag hidden deals, apply coupons correctly, or let you rerun a claim. And, never forget: You’re the customer. If one pharmacy refuses to honor a legitimate card, call their head office or try a competitor. Brand loyalty is less important than saving real cash.

Common Pitfalls That Can Blow Your Savings

Nothing’s more frustrating than finding a killer deal online, only to show up at the pharmacy and pay twice as much. Stacking mishaps and common traps can stomp all over your plans, but you can sidestep most with a little know-how.

Here’s what trips up even the savviest shoppers:

- Expired coupons: Digital apps and printable coupons occasionally expire or are updated, even if the site doesn’t look different. Always double-check the fine print before each fill.

- Non-participating pharmacies: Some stores, especially smaller independents or specific chain locations, opt out of the most popular discount networks. Don’t get stuck—ask before you drop off your script.

- Drug exclusions: Controlled substances, specialty drugs, and sometimes even select generics aren’t eligible for any card. Always run the drug’s name through the app before banking on savings.

- Mismatched codes: Each card has unique BIN, PCN, and Group numbers. Don’t mix them up or let the cashier guess—hand over the exact card or app screenshot for the drug and pharmacy you’re at.

- Insurance double-dipping: You cannot apply a pharmacy discount card on top of your normal insurance co-pay for the same script fill. If one gets denied, ask them to reverse it and run the other—sometimes the discount is better than insurance.

- Outdated pharmacy prices: The app may show $8, but the system at your pharmacy hasn’t refreshed in a week. Always ask for a price check before paying. If it’s not matching, try the next best app or card.

- Chain-specific loyalty programs: Some pharmacies have their own membership discounts that override external cards. Sometimes they’re better, sometimes not. Don’t automatically assume the in-house deal is tops.

- Paper vs digital confusion: Some locations insist on physical printouts, while others just want a digital code. Save both versions if you’re not sure.

Look, I’ve stood in a pharmacy line with a fussy kid (Ted, if you’re reading this—I still owe you for that meltdown over bubblegum-flavored syrup) so I know first-hand how stressy these moments get. Whenever possible, prep in advance so you’re not holding up the line. And remember, staff have seen it all—being patient and respectful goes a long way.

Upgrading Your Savings Game: Advanced Tips and Tools

There’s a difference between saving a few bucks on a script and knocking 70% off your pharmacy bill each month. Once you’ve got the basics of pharmacy discount card stacking down, there are a few advanced tactics to make savings nearly automatic.

- Automate price checks: Set a calendar reminder for each refill. When that alert pops up, spend five minutes running your med through your top three drug-savings apps. The best price might change month to month.

- Try bulk refills or larger quantities: Some discount card programs give a deeper deal if you fill a 90-day supply. This works especially well for maintenance meds like blood pressure pills or diabetes scripts.

- Explore new pharmacies: Don’t assume the closest chemist is the cheapest. Travel an extra five minutes if the savings are worth it—sometimes big-box stores or supermarket pharmacies have exclusive deals.

- Aim for generic alternatives: Always ask your doctor or pharmacist if a generic version is okay (and legal!). Cards overwhelmingly work best on generics, and it’s not unusual to shave 80% off compared to the brand-name cost.

- Leverage family or community: Share your best finds with friends, extended family members, or online forums. People often post up-to-the-minute deals or hidden local gems online.

- Check out the latest third-party programs: Not every good program is as famous as GoodRX or SingleCare. Platforms highlighted in reviews of drug-savings apps often pass savings along that bigger apps miss. The ecosystem changes fast, and there’s always a new player trying to grab your business with a killer introductory discount.

- Negotiate with your doctor: If you can get a 90-day supply (especially in chronic conditions), ask your prescriber to write for the largest allowable quantity per script—bulk purchases usually trigger bigger discounts.

If you’re someone who really wants to take things next level, try tracking your prescription spends in a spreadsheet (or even just on your phone’s notes app). This way, you’ll notice which discounts repeat, spot price trends, and know which pharmacy is worth sticking with for loyal customer perks.

A recent survey by the Australian Institute of Health and Welfare found that average household prescription spend sits around $45–$55 per month, but savvy shoppers can drop that by 30–60% just by working discount program angles. That’s cash in your pocket for better stuff—like the Friday fish and chips with your kids, or maybe just a few less guilty nights staring at the pharmacy total.

The bottom line: staying curious, shopping smart, and never assuming ‘the deal is the deal’ can change the script on pharmacy costs. Combining your knowledge of discount card stacking with a little hustler’s mindset leads to real dollars saved—money you can use for way better things.

This is a pretty neat breakdown on stacking pharmacy discounts. I’ve been doing this for a while, and honestly, it’s saved me a ton over the years. One thing I always stress is to never blindly assume all cards stack — pharmacies can be very particular about which ones they’ll accept together. It’s about knowing their system limitations and how the software applies discounts.

For example, some chains won’t let you combine a manufacturer coupon and a discount card, but you can sometimes stack a pharmacy loyalty program discount with a third-party savings card. Knowing these nuances is key. Also, apps like GoodRx or SingleCare are game-changers. They update deals often and can really knock down prices when paired cleverly.

That said, it’s crucial not to violate any terms of use — pharmacies have been tightening their policies to prevent abuse, so staying within the rules means no fake information or multiple cards under false pretenses. The post covers these points well, but I’d add that always call your pharmacy if you’re unsure. A quick question on their accepted discounts can save you hassles at checkout.

Anyone else have tips or personal hacks for this? I’m always open to hearing new tricks or experiences.

What an intriguing topic! The idea of stacking discounts gives a fascinating glimpse into the interplay of economics and access to healthcare. It’s almost like navigating a labyrinth, where every twist and turn reveals both opportunities and restrictions.

To me, it raises broader questions about the fairness and accessibility of our healthcare system. Discounts and saves can be helpful, but they also highlight the essential challenge that medicine should be affordable for all without needing elaborate strategies.

It’s heartening, however, to see consumers becoming savvy and empowered with knowledge. Understanding the legal landscape and drug-savings apps brings a certain agency that can make an otherwise overwhelming system more navigable.

At the same time, I wonder about the ethical lines firms set around these discounts and how they might affect long-term costs or insurance dynamics. Is there a risk that these legitimate hacks might inadvertently drive prices up elsewhere? Food for thought.

Anyway, great post. I appreciate the detailed explanation and hope this sparks further dialogue on pharmaceutical affordability.

i love posts like this cuz they feel super practical and, honestly, pharmacies dont make it easy for ppl to save money lol. but yeah its def possible to stack some of these cards if ya know what ur looking for.

one thing ive noticed tho is its easy to slip up and think u can use everything together but then get denied at the counter. so super important to double check each store’s rules and use apps that show u real-time info. my fav is the singlecare app — it’s pretty straightforward and helps me get the best deal without a headache.

on the flip side, be sure ur not breaking any terms like using multiple cards under diff names or something shady cuz that can get u blacklisted. legit game rules, you know?

def would love if anyone wants to share their own stacking combos or secret tips!

lol stacking discount cards is like a mini sport these days, right? i mean, it’s wild that we gotta play pharmacist coupon ninja to not pay full price.

but seriously, props to anyone who can juggle multiple cards without accidentally invalidating the deal. heard some horror stories where people thought they were smart stacking cards but pharmacy techs flagged the whole thing.

there’s def some shady edge cases tho. like, are we really supposed to trust every discount app? some seem sketchy or show insanely low prices that can’t be real. so careful and maybe double check or ask around before trusting weird deals.

what’s the most outrageous stacking combo anyone’s pulled off here?

I just want to add that while these hacks can be helpful in the short term, folks should also consider the long-term implications of relying heavily on discounts. From a formal perspective, insurance and pharmacy policies are ever-evolving, and what works today may be invalid tomorrow.

It’s wise to maintain a relationship with your pharmacist and understand your medication’s costs and available assistance programs. Some pharmaceutical companies have official patient assistance programs that might be more sustainable.

Using discount cards responsibly and ethically ensures that one avoids potential abuses that might cause these programs to be restricted or shut down in the future. Pragmatic vigilance is recommended.

just dropping in to say this is a great guide and super useful for folks who wanna save big on meds without any hassle.

one little tip i’ve found handy is keeping a digital folder on your phone with all your saved discount cards and coupons ready to go. makes checkout way faster and less stressful. also, always track expiration dates — some deals seem like forever but actually expire fast!

remember to remain polite with pharmacy staff; they’re the gatekeepers and usually happy to help if you’re nice. sometimes even a quick chat can get you tips on upcoming discounts or store-specific programs.

happy saving everyone!

i dont get why we gotta jump through all these hoops and mess with cards stacking at all. prices should be fair at the start. this kinda discount shuffling just delays the obvious need for reform.

but if we’re playing the game, the post nailed key points. never just assume you can slap cards together and slam pharmacy down with discounts. they got systems, laws, whatever you want to call 'em.

honestly this stuff feels like a patch for a broken system. everyone wants to squeeze savings, but the real win comes when meds cost less for everyone straight up.

still good to know how to work current options tho.

y tho we gotta jump thru so many loops just to get cheap meds? the whole discount card stacking thing just screams 'system designed to confuse and overcharge'. i bet few ppl really figure it all out.

the article mentioning legal risk is spot on. you mess with rules, even unintentionally, you could lose access. pharmacies are onto how people abuse stacking and will shut things down.

btw - does anyone else think some of these sketchy discount apps deliver more stress than savings? i tried a few and ended up paying more or waiting longer. maybe worth sticking to big-name apps only.

The post astutely unearths the contemporary dynamics endemic in discount card utilization, delineating the regulatory constraints and the operational intricacies that dictate their functional efficacy. Such financial stratagems, while ostensibly beneficial, are enmeshed within a network of jurisprudential stipulations that must be scrupulously navigated to obviate contravention.

One must be circumspect, not merely in the mechanics of application but cognizant of the broader socio-economic ramifications. Indeed, the empirical landscape suggests a paradigm where proliferating discount cards, if misapplied, could engender systemic inequities or market distortions.

Nevertheless, for the prudent user equipped with comprehensive understanding, these methods constitute indispensable tools for cost mitigation, reflecting a nuanced equilibrium between consumer advantage and regulatory compliance.

Am I the only one skeptical about the legit nature of stacking these pharmacy discount cards? I mean sure, it sounds great in theory, but when it comes to actual practice, things get messy real fast.

I've tried a handful of these stacking methods and half the time, the pharmacists look at me like I’m trying to pull a fast one. Some discount cards have so many hidden terms that it’s impossible to know what combos are actually allowed.

Also, those savings apps? Most are just gimmicks designed to push affiliate links and collect data. I’d rather stick to good old-fashioned insurance or manufacturer coupons. But maybe that’s just me being old school.

Anyway, nice post, just throwing out a bit of healthy skepticism.

I've been in the discount card game for a while, and honestly, the key to success is patience and research. Each pharmacy has their quirks, and each state might have different limitations on what discounts can be combined.

Also, keep in mind that some discounts apply only to certain types of prescriptions — some are better for brand-name drugs, others favor generics. It takes a bit of trial and error to find your best combo.

Moreover, technology has made things a bit easier. Some apps allow you to check your exact out-of-pocket costs before even arriving at the counter, which can save some embarrassment.

Still, I agree with the post: don’t try to break rules, because the penalties can simply cancel out your savings.